Bringing OnlyThisMuch books for Company Secretary Professional Programme very close to you through various sources of bookstores near you, online purchases, cash on delivery, order through VPP, etc… to enjoy passing CS exams.

Special Edition

This edition of OTM covers the following subjects in 4 books with interesting ways to learn, Objectives, past exam question papers of Company Secretary exams, case studies, lots of ideas to remember provisions. This edition is much more than the Amendments in laws which took place recently. You may also download the Amendments as applicable for CS exams from http://www.scribd.com/doc/93236216/Only-This-Much-Amendments-Laws-2012-Updates-for-Company-Secretary-Exams-on-Corporate-Economic-Securities-Secretarial-Practice-Drafting-Alliances. Hope you all will enjoy learning to the core. Do share your feedbacks with me on thisisvj@gmail.com

OTM – All 4 Modules for ACS Final

Module 1: Company Secretarial Practice (CSP) and Drafting, Appearances & Pleadings (DAP)

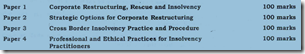

Module 2: Financial Treasury & Forex Management (FTFM) and Corporate Restructuring & Insolvency (CRI)

Module 3: Strategic Management, Alliances & International trade and Advance Tax laws & Practice (ATLP)

Module 4: Due Diligence & Corporate Compliance Management (DDCCM) and Corporate Governance, Business Ethics & Sustainability (CGBES).

Why to buy OTM for CS exams?

OTM always goes by the concept that “Nothing should be read unless otherwise its interesting”. In this special edition, extra effort is put on that to make it more interesting to learn. The subject on FTFM & ATLP is introduced for the first time ever in OTM series in a all new way to learn. This sure shot way to shun the fear every student has on Financial Management and Taxes. You need not ask any more the age old question of how to prepare for financial management in CS. Why taxes are so tough in CS exams?

OTM mistakes & feedbacks

Entire OTM team has put heart & soul into this edition as ever. Inspite of our that much caution, there might be errors and mistakes creeped in the books. Request you to point out the same to us, so that we may try rectifying atleast in future. Your feedbacks keeps us moving, my inbox is waiting for loads of same.

Where to buy OnlyThisMuch books!

How to buy OTM books were always a big problem with many CS students. This time we have tried increasing our retail presence also with the book stores near you. Even otherwise you can always rely online booksellers as they deliver you the books in 4 – 5 days without even using your credit card or debit card or netbanking as they are offering VPP (Value Payable Post) by taking Cash on Delivery (COD) for OTM books.

Buying OTM books online

If you are appearing for ALL 4 modules of CS Professional Programme in one attempt, then you can consider buying 4 sets of OTM Professional books in a lot from Flipkart at a discounted price. For more details, you may visit http://www.flipkart.com/only-much-9381904197/p/9789381904190?pid=9789381904190&ref=1ea0c170-7c9b-4767-8d99-654d64fb4af0

However you have an option to buy books separately also from the following links:

Buy OTM Professional Module 1 book: Flipkart Asialawhouse

Buy OTM Professional Module 2 book: Flipkart Asialawhouse

Buy OTM Professional Module 3 book: Flipkart Asialawhouse

Buy OTM Professional Module 4 book: Flipkart Asialawhouse

CS e-learning with OnlyThisMuch books

Yes, now you can enjoy listening to OTM while making your preparations for CS Professional Program as claimed in OnlyThisMuch books as “Read, Discuss, Record, Listen, Listen & Listen” at

Locate your nearest OTM bookstore now (Download)

| |

| Name of Bookstore where OTM is available | Address | Telephone No. |

| Books Emporium | 3, M.G. Bhavan,Old Nagardas Road,Opp. Chinai College, Andheri, Mumbai-400069 | 28203894 / 66770474 Mob: 09820651516 |

| Sapna Book House | The Book Mall,# 3rd Main, Gandhinagar,Bangalore-560009 | 40114455 |

| Ajit Law Book Depot | 31, Budhwar Peth,Near Jogeshwari Mandir,Behind Suvarna Sahakari Bank,Pune-411002 | 24451546/66034697 M: 9850954972 |

| Book Selection Centre | 3-5-121/E/1/2,Beside Shalimar Theatre,Ramkote,Hyderabad | 23446843 Mob: 09951666550 |

| Student Book Centre | 527, Kalbadevi Road,Opp. Edwards Cinema,Mumbai-400002 | 22050510/22011663 Mob:09820139068 |

| Gandhi Law House | 2, Shreyas Complex, Nr. Dinesh Hall,Behind Rushika Complex, Income Tax,Ashram Road,Ahmedabad-380009 | 26587666 Mob: 9825246364 |

| Ganesh Book Bureau | No.1, 17th Cross, Lakshmipuram,CMH Road, Ulsoor,Banglore-560008 | 080 25551145/41698633 Mob: 09845266516 |

| Law Book shop | 1st Floor, Oriental Complex,Banerji Road Market Road JN,Ernakulam, Kochi,Kerala-682018 | 2397895/ 2398484 |

| Asia Law House | # 10, Aiyanagar Plaza,Beside UTI Bank street, Kotih,Hyderabad-95 | 040 2474 2324 / 24608000 |

| DECCAN Law House | Near Hotel Raj Tower,ELURU RoadVijaywada-520002 | 2576242 Mob:9848532127 |

| Modern Book Depot | 15 A J L Nehru Road,Opp. Light House Cinema,Kolkata-7000 013 | 22490933, 22493102 |

| Venus Book Centre | Opp. Rajaram library,Ramnagar Road,Gokul Path, Nagpur-440010 | 2536314 |

| Pooja Law House | LGF, Hans Bhawan,I.T.O.,I.P. Estate,New Delhi-110002 | 011 - 23370152 & 23379103 |

| Singhania Books & Stationary | U-110, LG-1, Shakarpur,Main Vikas Marg,Infront of Laxmi Nagar Metro Station,Delhi-110092 | M: 9213168238 |

| Aggarwal Law House | Wing-II, Shop No. 2, LGF,Hans Bhawan, I.T.O.,New Delhi-110002 | 011 - 23379102 & 23378249 |

| | |

| The Book Corporation | Ahmedabad | 26465385/9327010323 |

| Standard | Ahmedabad | 27540731/27540732 |

| Karnavati | Ahmedabad | 26578319/26576299 |

| Modern Laq | Allahabad | 2560700/2560616 |

| Alia Law | Allahabad | 2560444 |

| Puliani & Puliani | Bangalore | 22266500/22264052 |

| M.P.P. | Bangalore | 22260706/22265901 |

| Law Link Publication | Bangalore | 9845057996 |

| Professionals Book | Belgaum | 2461681 |

| Hemdeep | Baroda | 2422603/2337503 |

| Sagar | Baroda | 2340933/2350293 |

| Suvidha Law House | Bhopal | 2551597/2559586 |

| Nupur Law | Bhopal | 2572741 |

| Bilaspur Law | Bilaspur | 9300333990 |

| Book Corporation | Kolkata | 22206669/22205367 |

| Law Point | Kolkata | 22101821/22483934 |

| Kamal Law | Kolkata | 22208941 |

| Tax-N-Laws | Kolkata | 22427092 |

| Veenus Book | Kolkata | 22483146 |

| Sarat Book House | Kolkata | Ph: 22418389 Mob: 09339759126 |

| Shivraj Book Agency | Kolkata | Mob: 9836850838 |

| Jain General | Chandigarh | 2702768 |

| Jain Law | Chandigarh | 2701615 |

| Mohindra Law | Chandigarh | 9417011540 |

| Ajay Law | Chandigarh | 9417184572 |

| C Sitaraman & Co | Chennai | 28111516/28117069/28113950 |

| Swami Law | Chennai | 2366285/2361341 |

| Law Book Shop | Chennai | 9447768991 |

| TR Publications Pvt Ltd | Chennai | 24340765 |

| V Angomuthu | Coimbatore | 2211585 |

| Natraj Publishers | Dehradun | 2653382/2654584 |

| Commercial House | New Delhi | 23947862/23267860 |

| Central News Agency | New Delhi | 43631313 |

| Dhanwantra | New Delhi | 23866768 |

| Gupta Book | New Delhi | 26449929 |

| Jain Book Agency | New Delhi | 23416390-94/26567066/26566113 |

| Jain Book Depot | New Delhi | 23416101-03/9891683582 |

| JM Jaina | New Delhi | 23915064 |

| Krishna Law | New Delhi | 23417866 |

| Standard | New Delhi | 23413899 |

| Laxmi Law | Ghaziabad | 9810579939 |

| Anshu | Ghaziabad | 9810903484 |

| Balaji Book | Gurgaon | 9810095379 |

| Jain Book Agency | Gurgaon | 4143020 |

| Khatelpal | Indore | 2540987 |

| Vedpal Law | Indore | 2543491 |

| Legal | Indore | 2543506 |

| Hind | Jabalpur | 2625642 |

| Bharat Law | Jaipur | 2316388/2321388 |

| Jain Professional | Jaipur | 2419331 |

| Kishore Book | Jaipur | 2362578 |

| Krishna Book | Jaipur | 2363891 |

| Lawman | Jaipur | 2553300 |

| Current | Jaipur | 2357842 |

| Prakash Law | Jodhpur | 2627658 |

| Law Book | Kanpur | 2311417 |

| Akhawat | Kanpur | 941505557 |

| Eagle | Karnal | 9416027279 |

| Ashish Law House | Lucknow | 9839710509 |

| Universal Book Distributors | Lucknow | 2324909/2333401 |

| Arora Law | Ludhiana | 2440390 |

| Law Book | Meerut | 2421589 |

| Western | Meerut | 2640778/2645778 |

| Bhayani | Mumbai | 22002966/22050884 |

| Jaina Book | Mumbai | 22012143/22018485 |

| New Book | Mumbai | 22054492/22016380 |

| M&J | Mumbai | 24134450 |

| Pragati | Mumbai | 22058242 |

| Tax print | Mumbai | 22693321 |

| Shanti Law | Nagpur | 2438647/2460698 |

| Sterling Book House | Mumbai | 22612521/22676046 |

| National Book Centre | Nasik | 2314821/Mob-9823358918 |

| Malhotra Books | Patna | 6410765 |

| Malhotra Bros | Patna | 2222914 |

| Gupta Law | Panipat | 9810364290 |

| Madaan | Patiala | 283375 |

| Universal Book Stall | Pune | 24450976/24451780 |

| Malhotra | Ranchi | 9308090536 |

| Bharat Law | Raipur | 9300206426 |

| Jain Law | Raipur | 9827930419 |

| Rohit | Rajkot | 2294288 |

| Law Book & Forms | Rajkot | 2234604 |

| GIRI Law House | Salem | 2416219 |

| Takur | Shimla | 2204515 |

| Ashoka Book | Udaipur | 2413813 |

| Mamta | Ujjain | 2513863 |

| Andhra | Visakhapatnam | 2265369 |

| Authors | Sivakasi, Tamilnadu | 222805 |

From https://docs.google.com/open?id=0B-36NqCFw_7NNXg2T3Q1MW5oWGc

Enjoy passing…CS exams :)